tn franchise and excise tax mailing address

State Tax Forms. FONCE-3 - Entity Types That May Qualify for the FONCE Exemption.

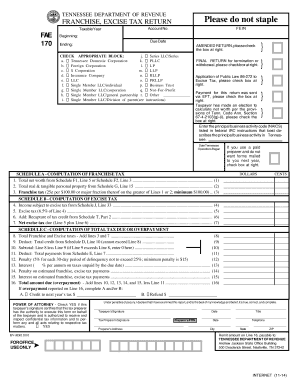

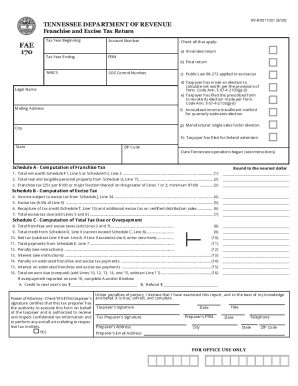

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Business Mailing Address City State Zip Code 14.

. Mail the completed Business Plan to. 4 rows Business Mailing Addresses. TENNESSEE DEPARTMENT OF REVENUE Franchise and Excise Tax Job Tax Credit Business Plan RV-F1308601 918 Taxpayer Name Account Number Mailing Address Number of New Jobs FEIN Capital Investment and Job Creation Investment Period.

FE-5 - Due Date for Filing Form FAE170 and Online Filing Requirement. All returns and payments filed before the end of May 2018 should be filed using the Departments existing franchise and excise tax website or through your software vendor. ET-1 - Excise Tax Computation.

615 253-0700 1-800-342-1003 ln State Toll-Free E-mail. TENNESSEE DEPARTMENT OF REVENUE Franchise and Excise Tax Return Tax Year Beginning Account Number Tax Year Ending NAICS Legal Name Mailing Address City State ZIP Code a Amended return b Final return c Public Law 86-272 applied to excise tax d Taxpayer has made an election to calculate net worth per the provisions of Tenn. Download or print the 2021 Tennessee Form FAE-170 Franchise and Excise Tax Return Kit for FREE from the Tennessee Department of Revenue.

FONCE-2 - Relationships That are Considered Family Members for the FONCE Exemption. Input the Contacts name phone number and email address. This application must be signed by an owner officer member or partner.

Tennessee Department of Revenue PO. Mailing address FEIN and franchise and excise tax account number. Department of the Treasury Internal Revenue Service Kansas City MO 64999-0002.

Internal Revenue Service PO. The filing fee is 50 per member with a minimum fee of 300 and. FONCE-1 - Qualification and Filing Requirements for the Family Owned Non-Corporate Entity FONCE Exemption.

Franchise Excise Tax Return Mailing Address Tennessee. Up to 25 cash back The annual report is due by the first day of the fourth month following the close of the LLCs fiscal year. Of the entity listed above.

And you are filing a Form. And you ARE ENCLOSING A PAYMENT then use this address. We last updated the Franchise and Excise Tax Return Kit in February 2022 so this is the latest version of Form FAE-170.

For industrial recruitment information call the Department of Economic and. Taxpayer Services 500 Deaderick Street Nashville Tennessee 37242 Phone. Box 1214 Charlotte NC 28201-1214.

Box 190644 Nashville TN 37219-0644 For tax assistance call 800 397-8395 in Tennessee or if you are located in the Nashville call area or out-of-state call 615 253-0700. FE-7 - The Date an Entity Formed Outside of TN Becomes Subject to. Tennessee Department of Revenue Attention.

Please view the topics below for more information. ET-2 - Federal Bonus Depreciation is. If your fiscal year is the calendar year the report is due by April 1.

Contact Name Contact Telephone Number Contact Email Address 16. If you have questions about Franchise And Excise Tax Online contact. Business Telephone Number Business Fax Number Business Email Address 15.

For example if your LLCs fiscal year closes on June 30 your annual report is due by October 1. Please view the topics below for more information. Fill in payment details.

If you live in TENNESSEE. Fill in the Taxpayer ID Type ID and Account ID. FONCE-4 - The FONCE Exemption When No Income Was Generated.

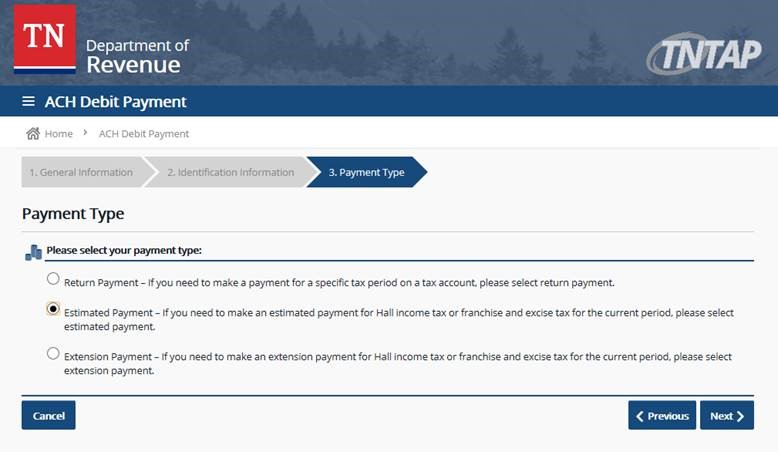

TN The Tennessee Department of Revenue has announced that franchise and excise tax filings are moving to Tennessee Taxpayer Access Point TNTAP at the end of May 2018. TNTAP is Tennessees free one-stop site for filing your taxes managing your account and viewing correspondence. For Account Type choose Franchise Excise Tax.

Donot print or use a stamp. FE-4 - Tennessee Filing Requirement for an LLC that Files Federally as an Individual or Division of a General Partnership. Choose the Period this should be the filing period end date you want the estimated payment to be credited towards.

FE-6 - Application for ExemptionAnnual Exemption Renewal Form FAE183 Due Date. The account number may be found by using. All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business conducted in Tennessee for the fiscal year.

All entities doing business in Tennessee and having a substantial nexus in Tennessee except for not-for-profits and other exempt entities are subject to the franchise tax. And you ARE NOT ENCLOSING A PAYMENT then use this address. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee.

Franchise Excise Tax - Excise Tax.

Get And Sign Tennessee Franchise And Excise Tax Form 2017 2022

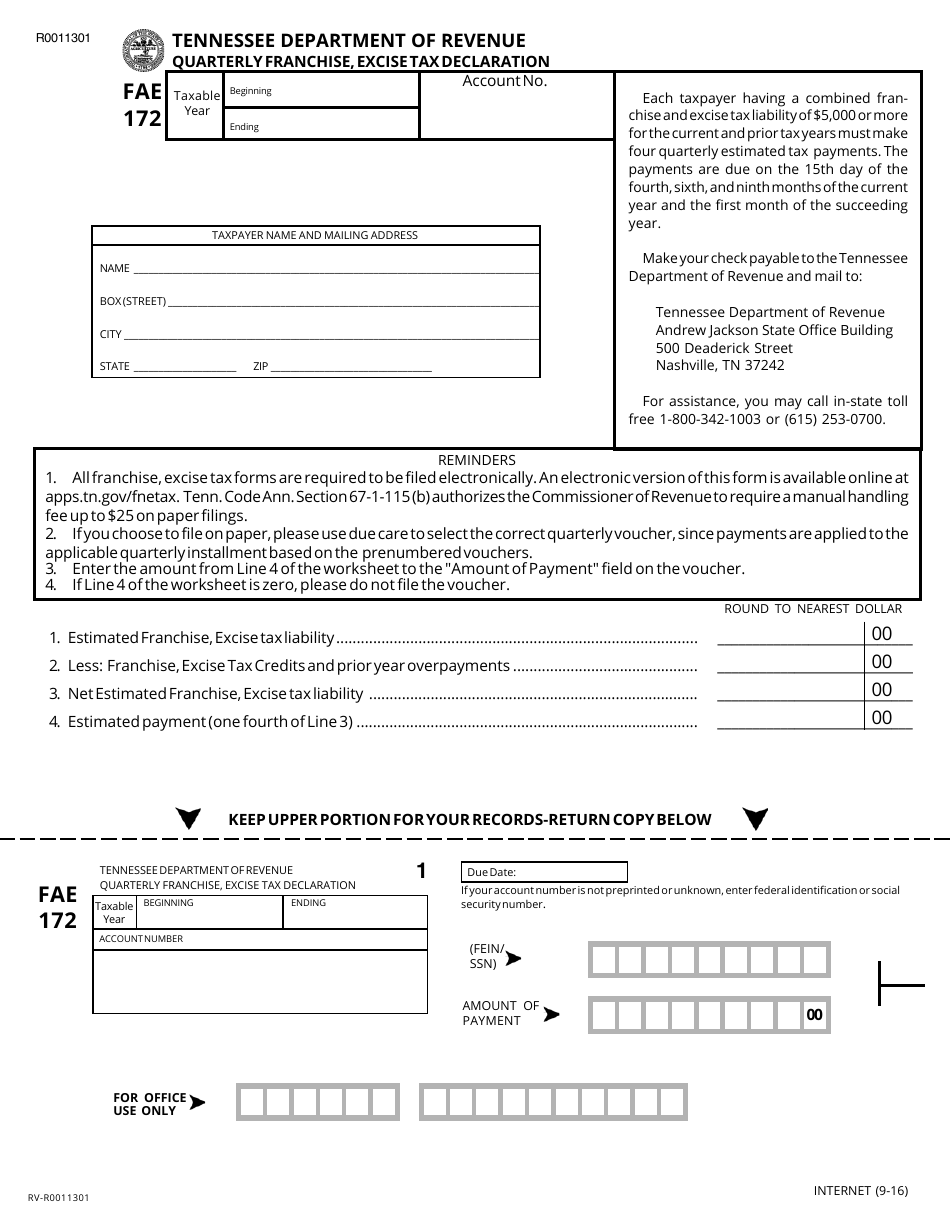

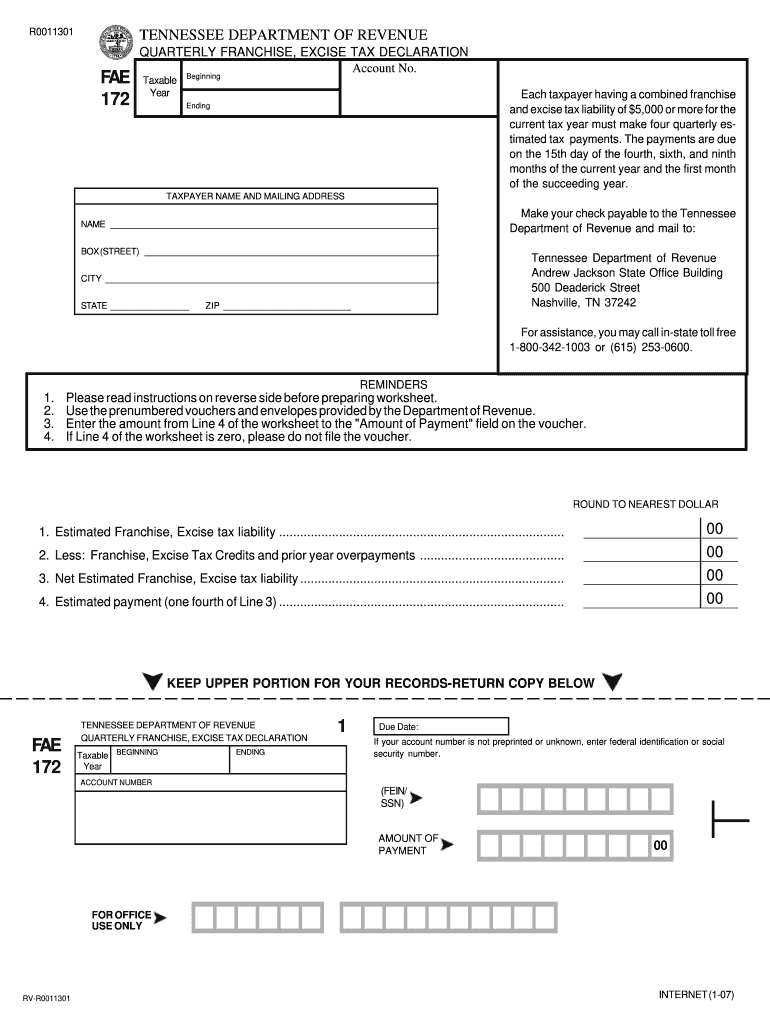

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

2017 2022 Form Tn Dor Fae 173 Fill Online Printable Fillable Blank Pdffiller

Franchise Excise Tax Consolidated Net Worth Election Applicaion Youtube

Fillable Online Forms Drafts Fae 170 Franchise Excise Tax Return Forms Drafts Fae 170 Franchise Excise Tax Return Fax Email Print Pdffiller

Tennessee Franchise Excise Tax Price Cpas

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com

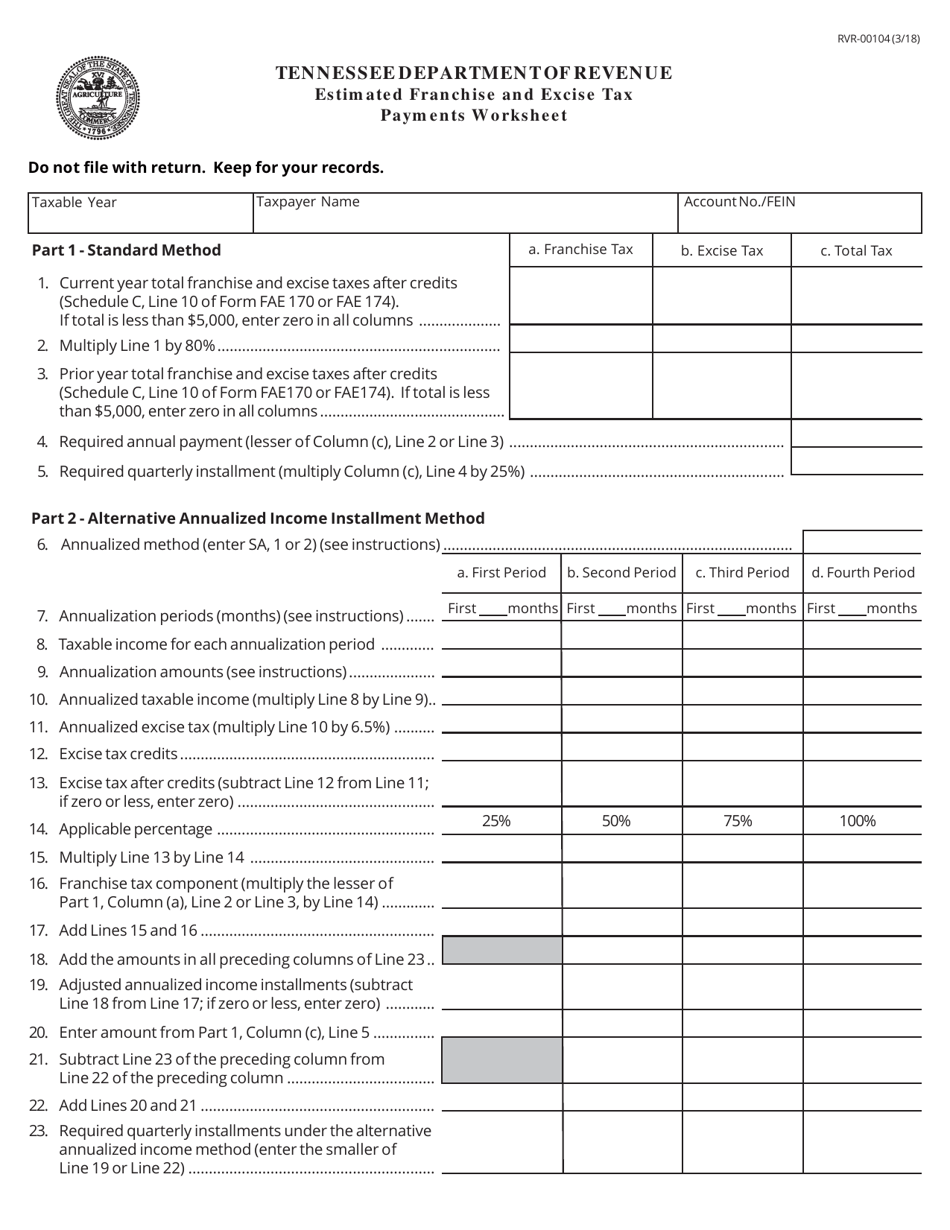

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Fillable Online State Tn Tennessee Tax Franchise Excise Federal Income Revision Form Fax Email Print Pdffiller

Tn Fae 170 Instructions 2020 Fill Online Printable Fillable Blank Pdffiller

Form Fae 170 Franchise And Excise Tax Return Kit

Tn Franchise Excise Tax Return Fill Out And Sign Printable Pdf Template Signnow

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Form Rvr 00104 Download Printable Pdf Or Fill Online Estimated Franchise And Excise Tax Payments Worksheet Tennessee Templateroller

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller